Eliminate Your Silent Partner in Retirement – the IRS.

Get Started Now!

Little-known strategies may help you reduce the amount of taxes you pay in retirement. Take advantage of the current tax environment and these tax tools:

- Get access to "The No-Compromise Retirement Plan," a leading book on retirement planning.

- Obtain private access to watch THE POWER OF ZERO: The Tax Train is Coming movie.

- Acquire your personalized Qualified Tax Report and much more!

Complete the form to get access to exclusive content and schedule an appointment.

Privacy Policy: All information provided is secure and confidential.

UNTIL TAXES GO UP

You'll Get Access to the Following:

Complimentary Book: "The No-Compromise Retirement Plan"

Access The Power of Zero Movie

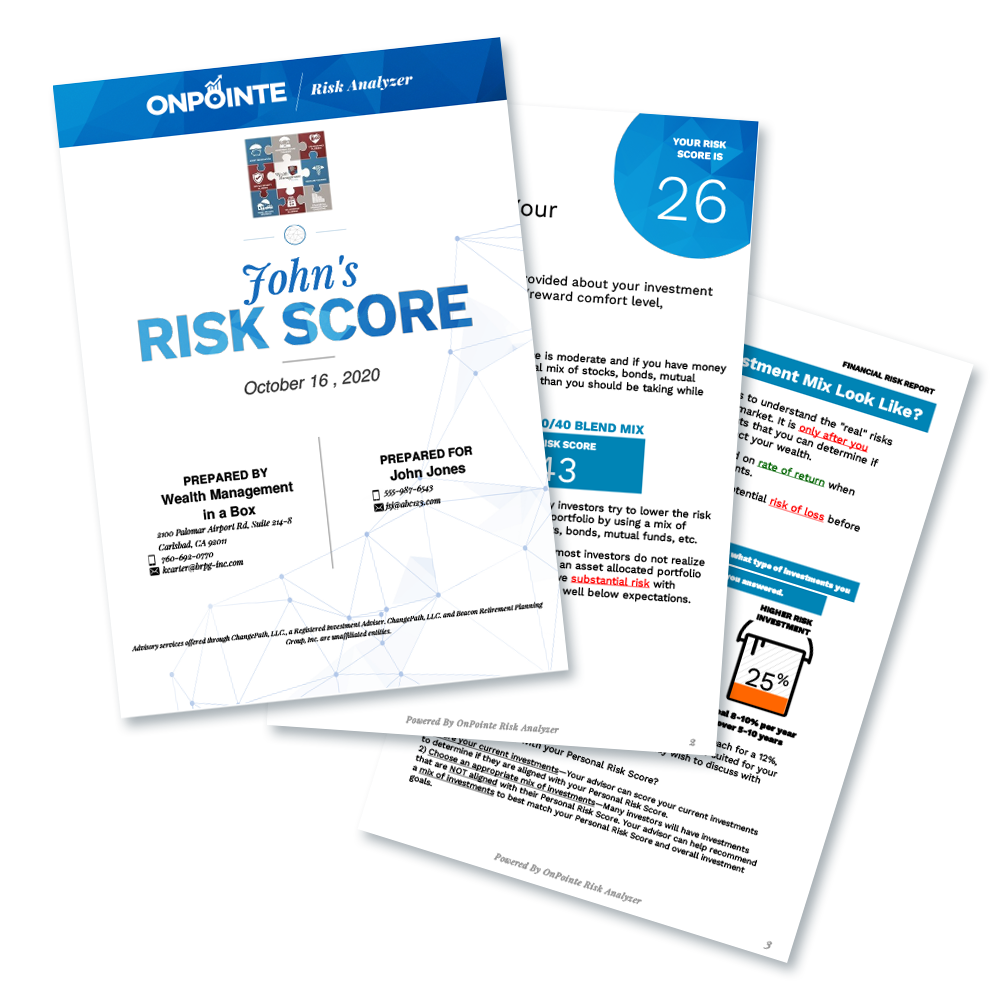

Get Your Free Personalized Qualified Tax Report

The Power of Zero: The Tax Train Is Coming takes an in-depth look at how the U.S. National Debt is setting the stage for massive tax increases and how they'll impact a retiring generation of Baby Boomers.

Do you know your financial risk score? What is your investment comfort range? What are your actual taxes in retirement? If these are questions you've never asked yourself, there's never been a better time to learn how to retire in the 0% tax bracket.

With more than 50,000 copies in circulation, it’s one of the leading books on retirement planning with a focus on tax efficiencies.

"The No-Compromise Retirement Plan" is a leading book on creating retirement income that works for you - not the IRS."

Beacon Retirement Planning Group, Inc.

Kelly J. Carter, Co-Founder & CEO

Kelly J. Carter is the co-founder/CEO of Beacon Retirement Planning Group, Inc. and has 28 years of experience as a financial life planner. BRPG is proud to be at the forefront of the pioneering trend of integrating life planning with financial planning. This dynamic team-based approach allows them to develop a comprehensive financial life plan that aligns each client's values and priorities. There is no “one size fits all” strategy for retirement planning and it is important to select an advisory firm who understands what is important to you.

Prior to founding BRPG, Kelly was responsible for the formation of a financial planning and estate planning team focused on targeted income planning, tax saving strategies and tax efficient wealth transfer for clients across the country and has headed up forums for hundreds of wealth preservation seminars and thousands of retirees throughout the U.S.

CA License #0E89958

Steve Conte, Co-Founder & President

Steve Conte has more than 30 years of experience in Corporate America, with emphasis in retirement financial planning, human resources and operations, both domestic and international. Steve has devoted the last 15 years of his professional career to working directly with pre-retirees and retirees, business owners, and professionals, providing alternative, safe solutions for their retirement needs.

Steve has been responsible for the design, development and management of pension plans and 401 (k) plans, as well as employee benefit and compensation plans. Steve brings an extensive background in financial management planning, human resources and operations to the programs he represents and understands.

CA License #0E36640

Copyright © 2022 Taxes Declassified | Privacy Policy

***Although qualified withdrawals from a Roth IRA are tax free, when converting a Traditional IRA into a Roth IRA, the entire converted taxable amount is reportable as income in the year of conversion.

Advisory Services offered through CreativeOne Wealth, LLC an Investment Advisor. Beacon Retirement Planning Group, Inc. and CreativeOne Wealth, LLC are not affiliated.

The information contained herein is based on our understanding of current tax law. The tax and legislative information may be subject to change and different interpretations. We recommend that you seek professional legal advice for applicability to your personal situation.

Licensed Insurance Professional. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. Attend and learn how annuities and life insurance can be used in various stages of planning for retirement income. This presentation is not intended to be legal or tax advice. The presenter can provide information, but not advice related to social security benefits. Clients should seek guidance from the Social Security Administration regarding their particular situation. The presenter may be able to identify potential retirement income gaps and may introduce insurance products, such as an annuity, as a potential solution. Social Security benefit payout rates can and will change at the sole discretion of the Social Security Administration. For more information, please consult a local Social Security Administration office, or visit www.ssa.gov.